|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

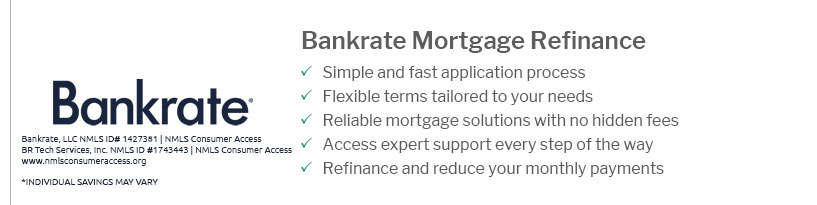

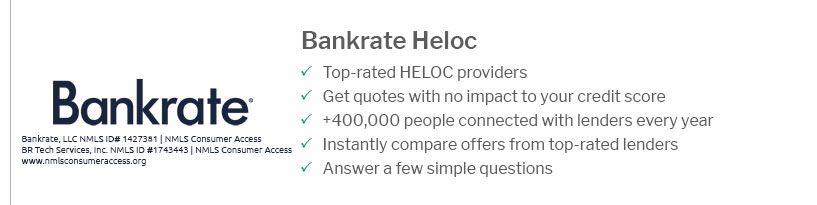

Refinance with Another Lender: Key Insights and BenefitsUnderstanding the Basics of RefinancingRefinancing with another lender involves replacing your current mortgage with a new one, usually to secure a lower interest rate or better terms. This process can lead to significant savings over time. Why Consider Refinancing?

Steps to Refinance with a New Lender

Potential Challenges in RefinancingCosts and FeesRefinancing can involve various fees, including application fees, appraisal fees, and closing costs, which may impact the overall benefit of refinancing. Credit Score ImpactApplying for a refinance can temporarily affect your credit score, so it's important to understand how this might influence your financial plans. FAQWhat are the main benefits of refinancing with another lender?The main benefits include securing a lower interest rate, improving loan terms, and potentially accessing cash through equity. Can refinancing help if I have bad credit?Yes, it is possible to refinance with bad credit, but it may involve higher interest rates. Researching the best home refinance for bad credit can help find suitable options. How long does the refinancing process take?The refinancing process typically takes 30 to 45 days, depending on the lender and the complexity of your financial situation. https://njlenders.com/blog/can-i-still-refinance-switching-terms-with-a-refinance

Overall, the best thing to do when considering refinancing your mortgage, is to speak with your loan officer. They will be able to help guide you in the right ... https://www.youtube.com/watch?v=Av5jXTZl2fs

Can I Refinance My Mortgage With A Different Lender? Considering a mortgage refinance with a different lender? You're in the right place! https://www.quora.com/Is-refinancing-a-mortgage-any-easier-if-you-use-your-existing-lender-instead-of-starting-over-with-a-new-bank

When choosing whether to refinance with your existing lender it really comes down to your relationship with your Loan Officer.

|

|---|